With global aquaculture projected to reach 106 million tons by 2030, finding alternative ingredients becomes paramount, given the strain on traditional sources like soy and fishmeal.

“In 2023, global aquafeed production reached 52.09 MMT (Alltech, 2023). So, the volume of protein-rich quality ingredients needs to accelerate to meet aquaculture growth demand,” says Linda Chen, Hatch Blue associate and lead author of the Emerging Protein-rich Ingredients for Aquaculture report.

While stressing the urgency of identifying competitive protein-rich ingredients that can complement existing feedstuffs and bridge that protein gap, the publication also emphasizes the inclusion of novel ingredients that do not compete with human consumption to ensure food security.

The research aims to guide stakeholders, including startups, investors, regulatory bodies, and industry leaders, in navigating the complexities of introducing and adopting emerging aquafeed ingredients.

“Diversifying raw materials in aquafeed formulation offers several advantages for formulators, including hedging against cost spikes, volume deficiency, and supply chain disruptions. By having a range of options, formulators can adapt more easily to fluctuations in ingredient availability and prices, ensuring continuity in feed production," Chen tells FeedNavigator.

Additionally, diversification allows for better utilization of existing ingredients. For example, complementing traditional sources like fishmeal with alternative proteins such as single-cell protein enables formulators to reduce reliance on costly or environmentally unsustainable ingredients without compromising on essential nutritional components.

"In this way, aquafeed can achieve balanced amino acid compositions while reducing the overall volume of high-cost ingredients,” she continues.

Market inclusion within 5 years

Despite the efforts of entrepreneurs in this field, major feed manufacturers have been slow to adopt novel ingredients due to cost barriers and the small-scale nature of most businesses involved.

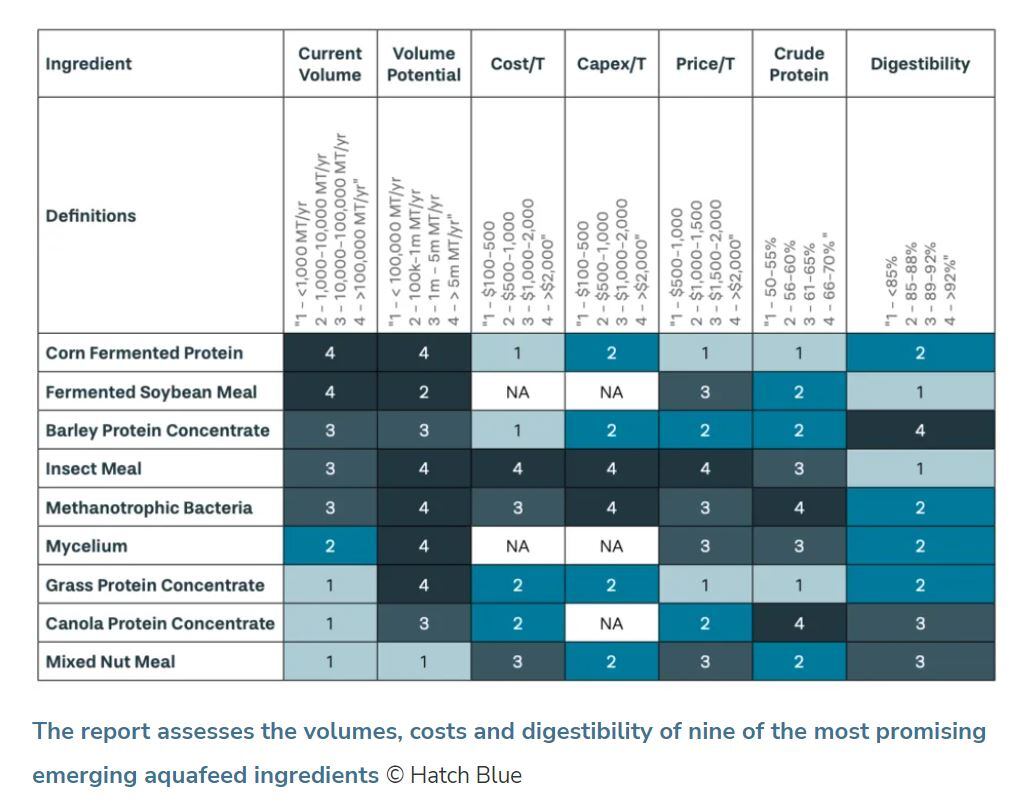

To address this challenge, the Hatch Blue team used specific criteria when evaluating potential ingredients for inclusion in salmon, shrimp and, to a lesser extent, tilapia diets, with a particular focus on nursery and grow-out stages. “The criteria included a minimum crude protein level of 50%, a minimum inclusion rate of 3% in commercial aquafeed, and a minimum total global annual production post-commercialization of 100,000 metric tons,” explains Chen.

Among the nine promising ingredients identified in the report are corn fermented protein, fermented soybean meal, and barley protein concentrate - they are expected to achieve scalable market inclusion within five years, remarks the author.

Additionally, insect meal and methanotrophic bacteria show promise for large-scale inclusion over a similar period, she maintains.

Other notable mentions include mycelium, grass protein concentrate, canola protein concentrate, and mixed nut meal, each contributing uniquely to addressing the protein gap in aquafeeds.

“We aren’t advocating specifically for one ingredient over another, instead we recognize that each ingredient listed plays an important role in fulfilling the protein gap in aqua feeds,” comments Chen.

The report provides detailed analyses of the nutritional profiles, estimated volumes, production costs, and challenges associated with each of the nine ingredients, with the idea of providing stakeholders with valuable insights into their potential market impact.

Standouts in the field

Scalable aquafeed market inclusion at > 100,000 MT in < 5 years:

- Corn fermented protein

- Fermented soybean meal

- Barley protein concentrate

Scalable aquafeed market inclusion at > 100,000 MT in > 5 years:

- Insect meal

- Methanotrophic bacteria

Notable mentions:

- Mycelium

- Grass protein concentrate

- Canola protein concentrate

- Mixed nut meal

Innovation trends

Current innovation trends in the emerging ingredient market are categorized into three principal areas:

- Improvement of protein extraction and reduction of anti-nutritional factors: Efforts are focused on enhancing the efficiency of protein extraction processes while minimizing anti-nutritional factors present in low-quality raw materials. This involves upcycling agricultural by-products or industrial side streams, which can rapidly reach higher volumes in the near term. The biorefinery concept, which generates multiple product streams, is gaining popularity, offering alternative revenue streams for agricultural and industrial producers.

- Repurposing commercial processes developed in the early 1990s: Novel ingredients are being produced by repurposing commercial processes established in the early 1990s. Examples include single-cell protein production and mycelium derived from paper industry side streams. While these processes originated decades ago, modern scale-up processes differ significantly, leading to high capital expenditure and complexities in both biological and engineering aspects.

- Genetic enhancement of existing agricultural crops for higher protein yields: Ongoing research aims to increase protein yields in existing agricultural crops, catering to both feed ingredient and food purposes. However, adoption of genetically altered crops faces challenges such as farmer acceptance and regulatory approval. Limited land availability for farming restricts the widespread adoption of these new genetic traits.

“We’ve found that, in the short term, by-products from existing agricultural and terrestrial production processes will contribute significant volumes of aquafeed ingredients. Upcycling low-value plant-based agricultural and ethanol by-products into protein-rich ingredients is associated with cheaper capex and production costs. The market is shifting toward the repurposing of brownfield infrastructure. The utilisation of waste materials can reduce the amount of landfill and contribute to a circular economy,” says Chen.

Barriers to adoption

The slow adoption of new aquafeed ingredients in the market can be attributed to several key factors, as outlined in the report:

One is the challenging production processes involved. “Setting up facilities to mass produce a single ingredient of consistent quality and quantity requires overcoming challenging engineering and biological hurdles, which require time, expertise, and capital. Especially for novel ingredients where production processes were not well understood or explored, the pioneer takes an unknown risk. Securing long-term offtake agreements can help alleviate some stress, but sometimes requires the completion of the trialing phase.”

Another factor is the financial aspect. “Emerging ingredient production often requires significant upfront capital to finance essential infrastructure, although capital with aligned risk appetite is often limited. At the preliminary stage, capital sources are needed to bridge ‘the valley of death’ between venture funding and risk-conscious institution money as production ramps up,” explains Chen.

Long trials and sale cycles are proving barriers as well. “Compound feed producers take on a lot of risk when they include new ingredients. They require demonstrated growth and health data to convince farmers and buyers. Emerging ingredients thus need to undergo rigorous in-house testing and long trial periods and meet consistent production volumes and nutritional values before they are seriously considered for significant inclusion in aquafeed formulations. Long sales cycles are challenging for ingredient producers, especially when development costs are high, to sustain innovation and optimization during the scale-up processes.”

Overcoming challenges

Asked what strategies innovators could adopt to overcome these hurdles, Chen says one approach is to enter higher-margin segments such as pet food. This strategy has been observed with insect producers who initially target pet food markets to generate revenue and gain traction during the initial scale-up phase.

Moreover, gaining farmer buy-in becomes crucial for driving adoption. Farmers' endorsement of ingredient inclusion can serve as a key driver for market acceptance, notes the author.

For investors, the report emphasizes the importance of expanding the scope of ingredients and identifying new financing strategies to support novel producers in overcoming the challenges of the ‘valley of death’ – the critical gap between venture funding and institutional investment. By diversifying investment portfolios and exploring innovative financing models, investors can facilitate the scale-up of production for emerging aquafeed ingredients.

Regulatory bodies are urged to play a proactive role in accelerating the approval process for novel ingredients and providing necessary support for their scale-up. Streamlining regulatory procedures can reduce barriers to market entry for innovative products, enabling faster adoption and commercialization. Additionally, regulatory support can encourage investment in research and development, fostering innovation in the aquafeed sector.

Industry leaders are encouraged to understand the challenges associated with offtake agreements and to be transparent in their sourcing requirements with novel producers. By fostering collaborative relationships with emerging ingredient suppliers, industry leaders can accelerate the adoption of innovative products and drive positive change in the aquafeed market, argues Chen.