Which work best? It is question tackled by Daniele Cesano, CEO of the start-up LandPrint, which has launched an agro-environmental rating system attempting to de-risk investments in regenerative farming.

As the planet grapples with “the alarming realities of climate change, biodiversity loss, and resource depletion”, he explained, calls are rising for the shift toward regenerative agriculture.

In the absence of a formal and standardised definition, Cesano defines regenerative agriculture as that which “serves to restore our natural capital, simultaneously promoting superior yield and increased profitability for farmers.” Instead of agonising over defining it, he stressed, “our efforts would be better spent establishing the minimum acceptable environmental quality standards for a farm”.

LandPrint is therefore committed to developing a robust, science-based protocol that leverages digital technologies to measure these standards on a scalable level across millions of hectares. “The defining of these acceptable standards ideally sits with corporations or government bodies and should encompass considerations such as water quality, biodiversity, soil health, and carbon stocks in forests and soils,” he explained. “These are the basic environmental assets a farm need to preserve to ensure competitive productivity over a long term.”

Traditional farming practices, meanwhile, are often deeply entrenched, said Cesano. “Shifting towards regenerative agriculture requires not just changes in farming techniques and specialised technical support, but also considerable financial outlays in the process.”

There is an understanding that the costs associated with this transition should not be solely borne by farmers – but should be shared by the main players in food value chains including, trading companies, food and beverage corporations, financial institutions, government programmes and ultimately consumers.

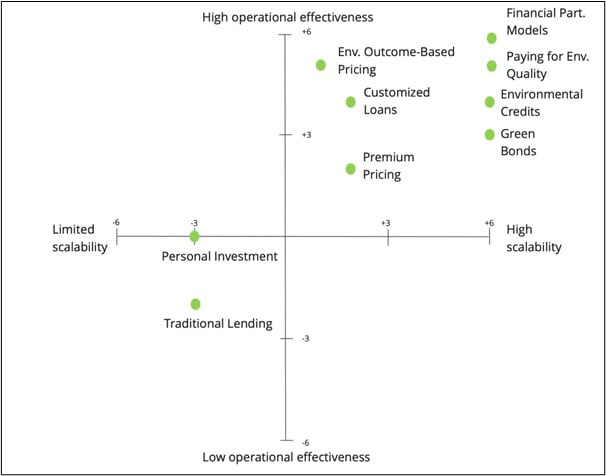

Cesano and his team has developed a quantitative environmental assessment framework (called LandPrint) based on soil health, water, carbon and biodiversity to link investment avenues - including personal investments, traditional loans, customized loans, green bonds, environmental credit mechanisms, optimised pricing models and financial partnerships - to regenerative agriculture outcomes.

The idea of the analysis is to “outline a general structure to bring more clarity on the way in which the sector is evolving to finance the restructuring of our food system,” he said.

For example, as food and beverage corporations embark on ambitious global environmental initiatives we are witnessing a surge in outcome-based frameworks and innovative systems. These outcomes might include increased soil health, carbon sequestration, biodiversity enhancement, and water resource management. But the precise business model for demonstrating corporate compliance is “still evolving and remains somewhat unclear”, Cesano warned.

Meanwhile, each financial structure has its pros and cons. For instance, customised loans for producers wanting to take up more sustainable agricultural and livestock production practices remain only moderately accessible for farmers who still bear all the transition risks if there is no lower interest rate, which may limit their scalability.

Green bonds have “galvanised” a formidable global movement of institutional investors, capital market participants, and policymakers committed to creating funding solutions for a sustainable future. Environmental outcome-based pricing is also gaining momentum and proving effective in supporting practice adoption. One of the first companies to implement it was the sportswear company PUMA through its Environmental Profit and Loss account. But both sectors face significant technical challenges, making them only moderately accessible for farmers and moderately efficient in their scaling impact.

Carbon credits and biodiversity credits get decent scores in Cesano’s analysis. They are becoming more accessible for farmers and are efficient in scaling impact, he said. But carbon markets have often faced criticism in the past for their lack of transparency, accessibility and quality.

Financial Partnership Models and Paying for Environmental Quality (PEQ) are also emerging as highly effective and scalable options. But they also highlight the importance of effective monitoring and measurement, as they depend on accurate data to reward farmers for achieving specific environmental quality standards.What needs to be proved is how the environmental benefits that are quantified through “green data” end up bringing solid economic values to the different value chain actors and not only to farmers, and how this additional cost will be passed on along the supply chain and eventually financed. This is a business model in the making, said Cesano,

“The LandPrint environmental outcomes measurement provides valuable insights to investors that want to understand the environmental outcomes of their investments," he concluded.

He added that any significant transition to regenerative agriculture may need the use of multiple financial instruments to address diverse challenges and opportunities.

“Overall, the assessment underscores the growing significance of monitoring and measurement within the framework of financial structures and instruments especially when these are used to improve the environmental performance of corporate supply chains,” he said.

“As the transition toward regenerative agriculture gains momentum, the ability to quantify and validate practice adoption and environmental outcomes becomes a key ingredient in ensuring the success and credibility of these financial mechanisms and the achievement of corporate sustainability targets.”

‘We quantify and qualify the environmental assets of a farm’

LandPrint has developed its environmental rating system based on a PAAS (Platform as a Service). It uses digital technologies to measure and certify the environmental quality of land and land use. “We have developed a system where we quantify and qualify the environmental assets of a farm,” Cesano told AgTechNavigator. “The only way we can ensure that farmlands preserve eco systems is to ensure that they are able to maximise their environmental quality as farmlands.”

After it rates the environmental asset of a farm, it will develop transition plans farms to improve their environmental stocks. The company then hopes this information will entice substantial capital investment from the financial and corporate sectors to facilitate sea change shift to regenerative agricultural practices.

So far, the start-up has measured around 6,000 hectares from four farmers in Latin America. “There are about 40-50 million hectares soy and grain markets in Brazil. We want to have at least 20% of the market in Brazil alone.”

Cargill tie-up

LandPrint is celebrating a recent tie-up with the Cargill Land Innovation Fund, which works with players in Argentina, Bolivia, Brazil, Paraguay and Uruguay through financing, technical assistance, and partnerships to ensure that the soy in the region is produced responsibly.

A farm in Maranhão, Brazil, was assessed on environmental quality, the level of adoption of regenerative agricultural practices, and its productive resilience. Soil samples were collected for analyses; a drone was flown to get data on the farm’s forest assets.

“This initiative helps us to quantify the degree of sustainability of the property in a concrete way, as well as identify points of improvement to establish personalised action plans for each production unit,” said Jorge Nascimento, a sustainability analyst at Cargill.

“The 1.5°C target is still alive,” Cesano added. “I think we can make a significant contribution to help mobilise the structured capital that is needed to achieve it."