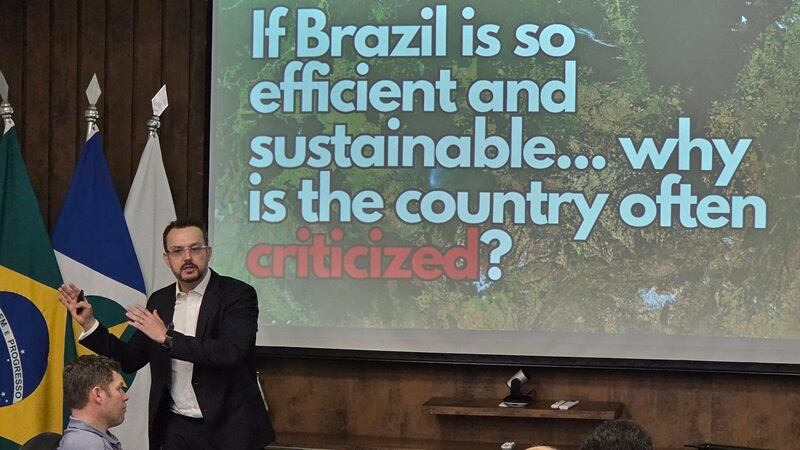

Brazilian agriculture had a record-breaking year in 2025, as the Latin American country expanded its markets across the globe, a key part of its future success, Daniel Barcelos Vargas, public policy professor at the Economics School of FGV at São Paulo, told AgTechNavigator during a press trip to Mato Grosso, hosted by Aprosoja (The Brazilian Association of Soy Producers).

Brazil’s agriculture sector faces several key challenges — high cost of capital, geopolitical tensions, and environmental pressures — which are directly impacting farming operations, he explained. Brazilian interest rates are high at 15%, which “does not seem to be viable for most producers,” he added.

Nearly a tenth (8.3%) of Brazilian farmers were delinquent on payments in the third quarter of 2025, up slightly from 8.1% of farmers in the previous quarter, according to reporting from Serasa Experian. While Brazilian ag exports have expanded, this comes as commodity prices for corn, soybeans, and other crops remain low.

“It is a very tough moment, and it is probably the hardest moment in economic terms of Brazilian farmers, at least in the last five years, and we only hear criticisms, complaints, and a lot of concerns about the future,” he elaborated.

Brazil responds to global isolationism by opening markets

Last year, Brazil faced tariff increases from the Trump administration, but instead of succumbing to the pressures, the sector diversified its export markets, leading to growth, Vargas explained.

“The U.S. imposed very significant tariffs on Brazil. One of the expectations [was] ... that it would somehow constrain, diminish the capacity of the sector in the country, and maybe force some political, ideological changes in the country. But what happened in practice was that Brazil increased its exports of meat, and the sector was actually growing faster than it was before,” he elaborated.

As parts of the world embrace trade protectionism, Brazil has become “a very strong defender of multilateralism and open markets” for its ag sector, leading to market growth, Vargas said. For instance, Brazil’s beef sector exported $17.9 billion worth of goods in 2025, increasing by 39.9% in dollars and 20.4% in volumes, thanks to expansion into 11 additional markets, according to government data.

“If the world wants to close down, we need to do the opposite effort and create more markets and engage globally in this economic diplomacy,” he emphasized.

Brazil’s agile ag sector creates opportunities in other industries

Brazil’s agile and flexible ag sector is also creating opportunities beyond the traditional market boundaries, Vargas explained.

For instance, Brazilian agriculture is fueling the country’s biofuel industry, which is in turn creating products to feed back into the farming sector, like in the case of Inpasa producing Distiller’s dried grains with solubles (DDGS). Soybean, corn, and cattle production are creating opportunities to create bio-methane, he added.

Brazil is “incorporating new technologies and new techniques to produce sustainable energy out of the residues of the conventional crop. So, we are constantly utilizing the residues of one economic activity to turn it into the raw material for a second economic activity,” Vargas elaborated.