Spanish authorities are investigating whether the African swine fever (ASF) outbreak detected in wild boar outside Barcelona may have originated from a research lab – a new line of inquiry that comes as export bans hurt the EU’s largest pork supplier.

Thirteen ASF cases have been confirmed in wild boar in Catalonia since 28 November, triggering an aggressive containment effort to protect Spain’s €8.8bn pork export industry.

What began as a presumed case of contaminated food waste - a discarded meat sandwich - has escalated into a probe targeting five nearby laboratories after genetic analysis revealed the virus strain does not match those circulating elsewhere in the EU.

According to Spain’s agriculture ministry, the virus identified in Catalonia is instead similar to the strain detected in Georgia in 2007.

“The discovery of a virus similar to the one that circulated in Georgia does not, therefore, rule out the possibility that its origin lies in a biological containment facility,” the ministry said on Friday.

Exports hit, prices crash

Eva Gocsik, global strategist for animal protein at Rabobank, told AgTechNavigator that the disease situation is still evolving, and the origin of the outbreak remains uncertain.

“The number of cases has risen from the initial two to 13,” Gocsik said. “All cases are in wild boars and located in the core zone.”

The trade fallout, she noted, has been “quite severe.”

“A number of key export destinations, including Japan, suspended pork imports from Spain, while others introduced regional bans,” she said. Exports within the EU continue under regionalization rules, but market pressure is intensifying.

The Spanish industry has already signaled production cuts as prices collapse. Live pig prices fell 16% last week, while piglet prices plunged 28%, Gocsik said. Catalonia has announced an emergency €10m aid package - expandable to €20m (US$23.2m) - to support farmers.

The impact is already being felt across Europe’s pork sector. With Spain likely to divert more product into the already oversupplied EU market, prices in the Netherlands and Denmark have dropped sharply.

- Dutch processor Vion cut carcass prices 6% WoW, and piglet prices are down 5%.

- Denmark reduced carcass prices 5% WoW.

“Falling prices are exerting strong pressure on producer margins,” Gocsik warned, noting that the EU market was already soft due to oversupply and China’s antidumping measures.

Global pork flows

A spokesperson for Swiss market intelligence firm Kemiex described the initial discovery of ASF in the Spanish market as “a shock to our customers and markets,” highlighting that country’s vital role in global pork flows.

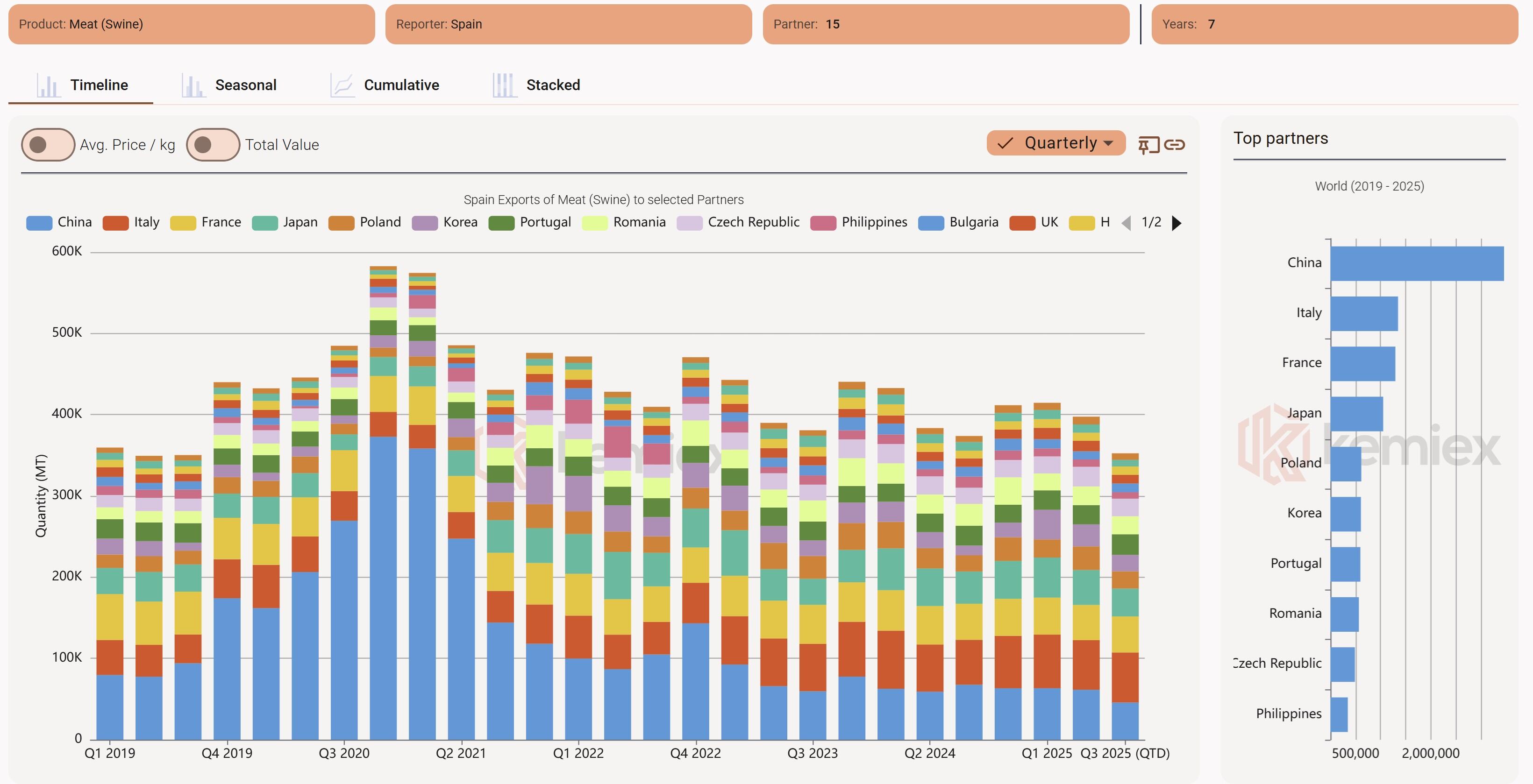

“Spain controls 26% of EU pork production and supplies roughly 25–30% of China’s pork imports, making this the country’s most significant African swine fever outbreak since 1994,” the spokesperson said.

Early blanket bans by major partners were quickly downgraded to regional restrictions - an intervention that prevented deeper market turmoil.

“The EU Commission designated 91 municipalities in Barcelona province as the infected zone while explicitly excluding major pig-producing areas in Osona and Lluçanès. Spain and Catalonia’s years of preparation enabled swift, effective containment measures,” Kemiex continued.

While describing the situation as “a disaster,” the data provider urged the sector to consider the broader trade landscape.

“Only 14% of EU27 production is exported outside the bloc. Spain also exports notable volumes to Italy, France, Poland, and other EU countries,” the Kemiex spokesperson said.

But China - Spain’s largest customer - is a looming risk factor.

“China is struggling with an oversupplied domestic market pushing prices down and prompting the state to control supplies in 2025,” they said. “The worst-case scenario for Europe would be further spread to domestic herds and if China moves to alternate suppliers like Brazil - a shift supported by a strong Euro making European pork more expensive.”

Next weeks are critical

With a potentially lab derived ASF strain, sharp market corrections, and nervous trading partners, Spain now stands at a crossroads.

Containment efforts in Catalonia are intensifying, but so are economic pressures across Europe’s pig sector. The coming weeks will determine whether the outbreak remains a localized wildlife event or becomes a broader crisis.