PA Consulting surveyed 600 senior leaders across airlines, airports, investors, producers, regulators and policymakers and found 54% see sustainable aviation fuel (SAF) as key to UK national energy security. Four in five (78%) think SAF is promising for job creation.

There is a ‘generational opportunity’ for the UK to lead in more sustainable aviation fuels, create thousands of future-proof jobs, and attract over £10 billion in investment by 2030, the report concluded.

Key findings

- SAF is seen as achieving more than just sustainability goals – 77% of UK respondents believe SAF holds promise for job creation in the UK. 57% of investors, airlines, and airport respondents see SAF as critical to national energy security.

- The industry is united behind the promise of SAF – 96% of UK respondents cite SAF as essential to aviation’s decarbonisation efforts but only around a third (34%) believe widespread adoption will be achieved by 2030.

- Most airports lack a clear path to sustainability – 52% of UK airport respondents don’t have a SAF strategy and almost half (45%) haven’t drawn up a net zero roadmap.

‘Fragmented and slow’ policy progress

But SAF projects often stall at pilot stage. Those surveyed said more targeted policy is needed to overcome key barriers such high costs, limited production capacity, and insufficient cross-industry collaboration.

The government’s Advanced Fuels Fund (AFF) has allocated around £198 million to SAF production since 2022, supporting around 1,400 jobs. The UK’s broader Jet Zero Strategy includes a commitment to produce at least 10% SAF by 2030.

But the report called for faster roll out of the Revenue Certainty Mechanism (RCM) which is designed to speed commercial deployment of SAF by guaranteeing stable returns for producers.

“The deployment of the RCM will help provide certainty to both current and aspiring SAF producers and increase the likelihood that more sustainable feedstocks are drawn on,” PA Consulting’s energy transition, climate tech, and decarbonisation expert Gian Dapul told AgTechNavigator.

More incentives and feedstocks required

Other policies encourage SAF uptake. The Renewable Transport Fuel Obligation (RTFO) requires fuel suppliers in the transport sector to ensure a certain percentage comes from renewable sources.

Another – the SAF Mandate – sets legally binding annual targets for aviation fuel suppliers to blend increasing amounts of SAF into their total jet fuel supply. This starts at 2% in 2025, rising to 10% by 2030 and 22% by 2040.

But other specific policies may be necessary to incentivise the use of specific types of feedstocks. PA Consulting’ global aviation lead Kata Cserep told us: “Aside from mandatory SAF blending targets, which are already in place in the UK and EU, our global respondents across the value chain believe the most important policy support types to encourage SAF investment are SAF production subsidies or tax incentives, stronger carbon pricing mechanisms to incentivise SAF, more consistent alignment on SAF standards and policies, nationally and internationally, and financial support for infrastructure development.”

More feedstock options are also needed in the long term, said Dapul.

Readily available feedstocks for the UK’s SAF sector do exist, such as agricultural plant wastes and animal agriculture (inedible fats and greases). But more cross-sector education and improved supply chains between agricultural players and fuel producers would help draw on this feedstock, Dapul said.

Municipal solid waste can also be processed for conversion into SAF. But improved waste collection and management is needed to allow prospective SAF producers to “more easily draw on a fairly abundant source of energy that is mostly either incinerated or sent to landfill in the UK,” Dapul pointed out.

Finally, the UK has a number of scalable biogas/biomethane sources – such as waste processing and landfill gas collection that could be used for production of SAF via the Fischer-Tropsch pathway. “Building more waste treatment facilities and better biomethane transport infrastructure would increase the supply of biomethane available to SAF producers,” suggested Dapul.

Land use concerns

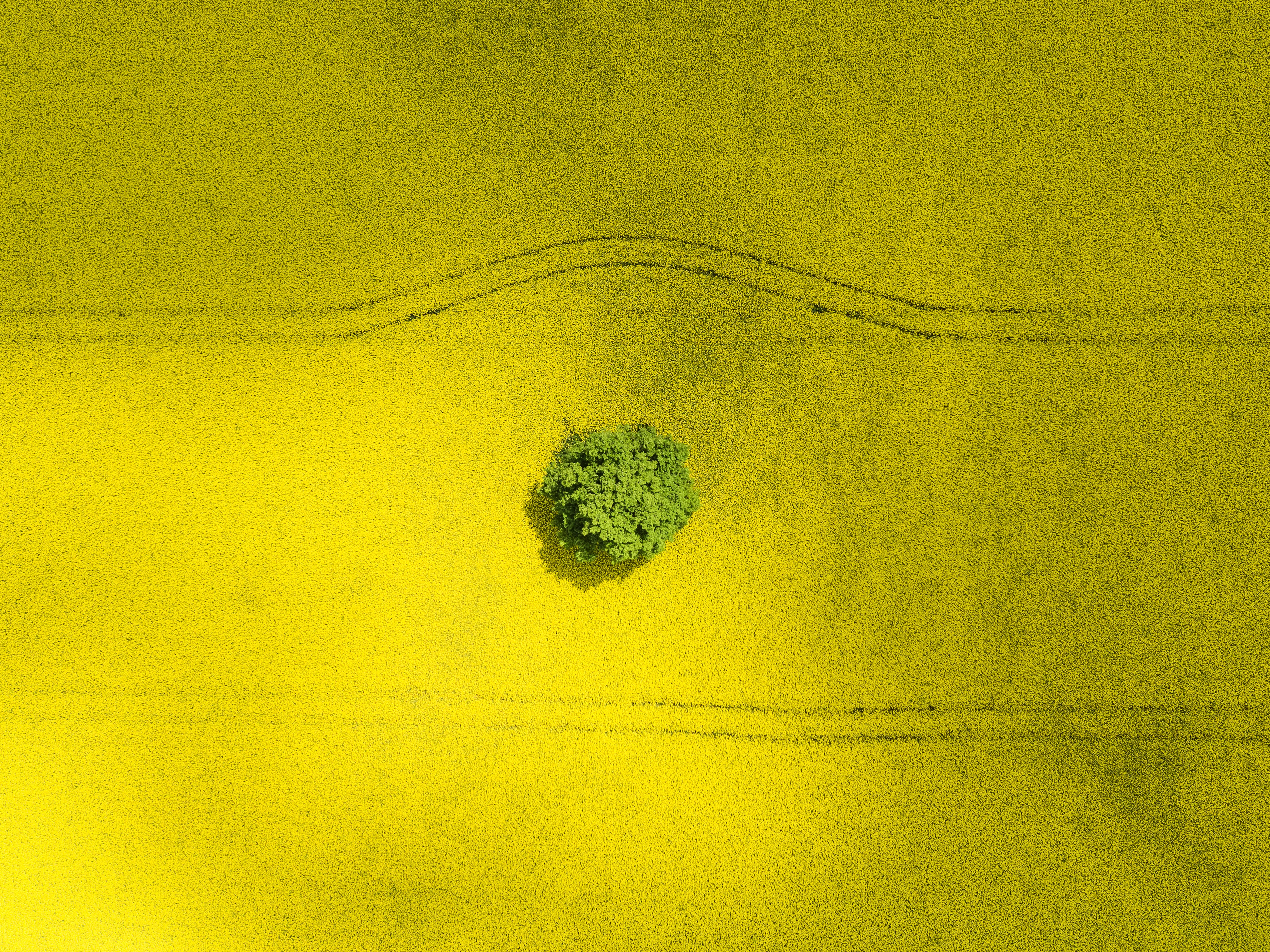

One issue limiting the options for SAF feedstocks is that traditional or primary crops are excluded from the materials allowed under the UK’s SAF mandate because of land use concerns. Meeting UK jet fuel demand entirely with rapeseed biofuel, for example, would require up to 68% of the UK’s agricultural land, according to a Royal Society report.

The SAF mandate instead prioritises feedstocks that are wastes and residues of biological origin, renewable sources used for power-to-liquid fuels, non-renewable fossil wastes designated as recycled carbon fuel, and nuclear energy used for PtL fuels.

That’s different to other markets. US company CoverCress, for example, is looking to fuel jet engines with pennycress – historically regarded as a common weed.

Future potential sources of sustainable fuel

Is feedstock availability sufficient in the UK? Oil- and grease-based HEFA (hydroprocessed esters and fatty acids) feedstocks are most available technology for SAF production in the near-term, Dapul pointed out.

But production often relies on imports of feedstocks like used cooking oil and because HEFA feedstocks are expected to be limited, the UK has placed a cap on these in the UK mandate. There aren’t enough SAF plants currently in the pipeline to threaten a feedstock shortage, Dapul said, but if the UK did have enough SAF capacity, “feedstock importation may indeed be necessary to meet the amount of SAF required to meet the UK’s medium-term targets”.

Without enough oil- and grease-based HEFA, additional sources of renewable energy and the production of green hydrogen for eFuels may be needed to over time to help address a number of SAF feedstock limitations, added Dapul

“In the long term, the UK will need to continue to scale renewable energy and infrastructure for the production of green hydrogen as these will be essential for eFuels production specifically called out under the UK SAF mandates.”