Associated British Foods (ABF) has confirmed it will shut down Vivergo, its bioethanol and animal feed production facility in Hull, by 31 August 2025, citing a lack of government support and regulatory certainty.

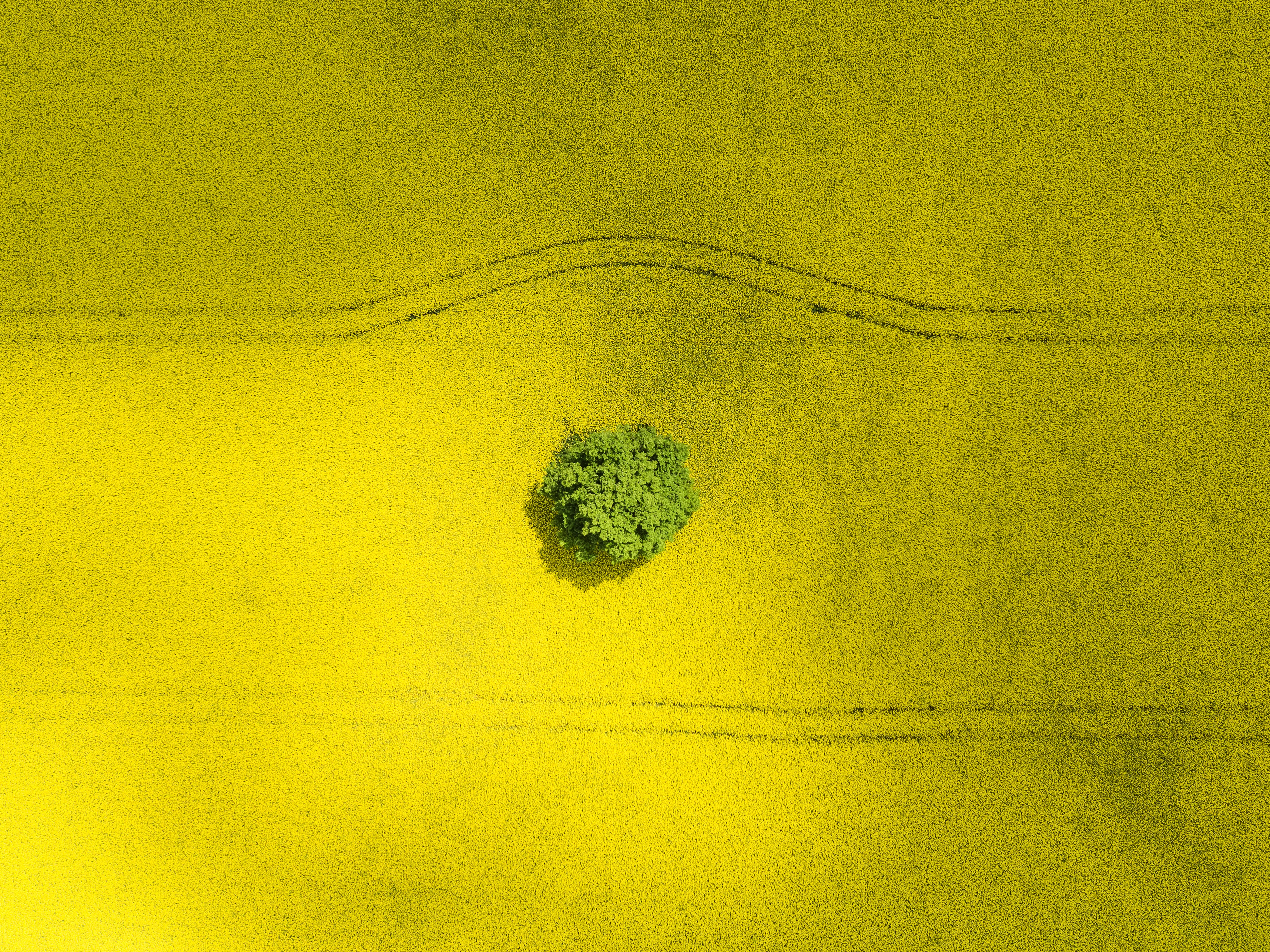

Vivergo is the UK’s largest bioethanol plant and the country’s single biggest wheat intake point, processing over one million tons of feed-grade wheat annually at full capacity. Since opening in 2012, it has sourced grain from more than 12,000 farms, primarily across Yorkshire and Lincolnshire, to produce fuel ethanol, high-protein animal feed, and CO2 for medical and industrial use.

ABF said the decision follows “extensive discussions” with the UK government over financial and regulatory measures to allow Vivergo to operate profitably. The company argued that UK bioethanol producers have been disadvantaged by regulations favoring imports, a situation exacerbated by the government’s May decision to remove tariffs on US bioethanol.

Vivergo would inevitably continue to be heavily loss-making without corrective government intervention, it stressed.

“Given these circumstances and the financial losses already incurred, ABF has therefore determined in the interests of its shareholders that it cannot continue to support Vivergo.”

ABF had previously described bioethanol refining as a “sovereign capability worth keeping,” highlighting its role in supplying high-grade fuels, domestic CO2 for the NHS, and reliable winter cattle feed.

Earlier challenges

The Vivergo plant faced instability before. It was mothballed in September 2018, with ABF keeping the facility on standby in the hope market conditions would improve. Following the UK government’s announcement to roll out E10 petrol and stronger bioethanol demand, the facility was restarted in early 2022.

Ensus fights on

The UK’s other major bioethanol producer, Ensus, is continuing to negotiate with government to secure its future. The plant, based at the Wilton International site on Teesside, is owned by Südzucker subsidiary CropEnergies.

Grant Pearson, chair of Ensus UK, said earlier this month he had met with business minister Sarah Jones, who acknowledged Ensus’s contribution to the UK economy, jobs in the Northeast, and its production of biogenic CO2 - a product he called “of critical national importance.”

Pearson said discussions on long-term arrangements are ongoing but stressed that short-term assurances are urgently required.

Last November saw CropEnergies announce it was pausing investment plans in high protein animal feed at Ensus UK, citing low ethanol prices and import pressures.

CO2 market risks

The closure of Vivergo, and uncertainty around Ensus, has reignited fears of CO2 shortages across the UK food and drink supply chain. Together, the two plants previously accounted for over 30% of domestic CO2 production.

Nick Allen, chief executive of the British Meat Processing Association (BMPA), warned the UK could be left entirely dependent on a handful of EU producers for CO2 supplies, exposing the pig and poultry sector to renewed shortages and price volatility.

Without Ensus, the UK will be reliant on imported CO2, with fewer suppliers and increased risk of disruption, Allen cautioned.