‘There’s distrust in the traditional system’... Nile.ag on why Africa’s farmers want to trade digitally

What began as a marketplace for streamlining fresh produce sales has evolved into a comprehensive digital farmer ecosystem. Nile.ag’s co-founder Louis de Kock tells Harry Holmes what’s driving growth.

It was the Covid-induced closures of South Africa’s fruit and veg markets that triggered three friends to start building an online alternative.

Louis de Kock, Eugene Roodt and Rick Kleinhans were scattered across three continents at the time, but returned home to South Africa to engineer a solution that would enable farmers to sustain a livelihood and keep food supplies flowing across South Africa.

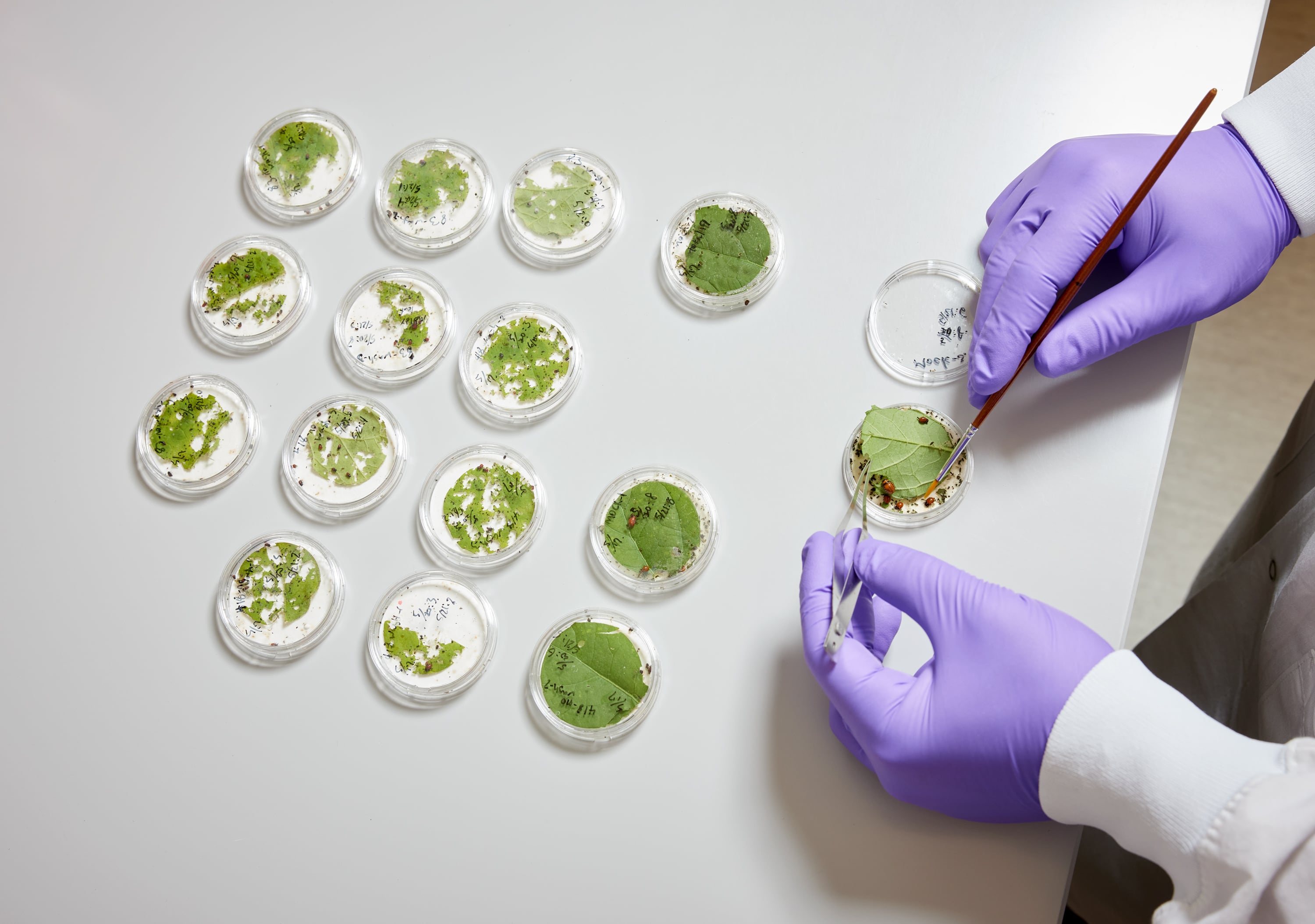

‘There are so many things we can do with this’... Terrana Biosciences to unleash RNA-based crop protection

Flagship Pioneering – the US company behind RNA-based vaccine maker Moderna and ag trailblazers Indigo and Inari – has unveiled Terrana Biosciences after four years in stealth. Its RNA platform has a host of potential applications in agriculture, Terrana CEO Ryan Rapp, tells us.

Terrana’s RNA-based technology platform is developing solutions that tick various boxes – from protecting crops from diseases and pests and enhancing plant resilience to climate stressors to increasing crop yields and maintaining soil health.

Flagship has initially committed $50 million to Terrana to scale operations and develop its first products. The initial focus is on crop protection and designing antivirals for plants and RNA-based alternatives to traditional pesticides, Rapp told AgTechNavigator.

Can Brazil become the world’s largest carbon market?

Brazil’s sustainable ag sector is propelling the country’s economy, while government action and innovative technologies are crucial to developing its next hot commodity — carbon.

Brazil’s sustainable ag sector is booming with the help of agtech, opening up an opportunity for the country to develop into a premier carbon market, Fabiana Alves, CEO Brazil and GM South America for Rabobank, told AgTechNavigator at the 2025 Agri-Tech South America Summit in São Paulo, June 24-25.

“We are living in ... a world of amazing, magnificent opportunities for Brazil to become the regenerative nutrition provider globally — to reposition itself as a country and to create a value-added brand based on green and digital agriculture,” Alves elaborated. Brazil has an “opportunity to become the largest carbon exporter and to make carbon our next commodity.”

Does agtech have a terminology problem?

The agtech sector has language issues that impact understanding and adoption within the agricultural sector, experts have warned.

The word ‘agtech’ itself is broad and ambiguous, farming specialists told AgTechNavigator’s recent webinar event that discussed farmer adoption.

Jargon can alienate farmers and create a disconnect between user and provider, said Tom Slattery, farming innovation support manager at the UK Agritech Centre.

“Terms like agtech or innovation have become quite off putting. Farmers don’t see themselves as innovators. They are open to technology if it is practical, solves real, on-farm challenges and is respectful of their time. Often those things aren’t considered enough.”

Global supply chains ‘alarmingly underprepared’ for EUDR

Product segregation is a critical challenge for agribusinesses as the EU’s deforestation regulation takes effect, says traceability expert Koltiva.

Just 30% of upstream suppliers and 12% of those downstream have established systems to trace deforestation risks, a 2025 Forbes analysis has revealed – putting ‘billions’ in EU-bound trade at serious risk.

The notorious and controversial European Union Deforestation Regulation (EUDR) began enforcement on 30 June 2026 for small companies and will come into force on 30 December 2025 for larger ones.

Only commodities and derived products that are traceable, deforestation-free, legally produced, and properly documented as such are EUDR compliant and eligible for the EU market.

Carbon credits... a hit or miss for Europe’s agtech sector?

Europe has untapped demand for nature-based carbon credits, according to separate reports from Estonia-based climate tech company Arbonics and UK specialist bank Oxbury.

European corporates are showing a strong willingness to pay a premium for high-quality, nature-based credits to meet rapidly approaching 2030 sustainability goals, despite controversy surrounding this method for reducing greenhouse gas emissions.

Carbon credit demand is not being fully met by the current supply, suggesting the agtech industry is well-positioned to capitalise – particularly those companies who are enabling farmers and landowners to quantify, verify, and sell carbon credits.

European carbon removal developer Arbonics reported that less than 1,000 of the total 13.3 million nature-based carbon credits issued last year under Verra (the body that certifies the projects) were from afforestation projects in Europe.

Agtech funding in 2025 ‘is not all doom and gloom,’ Rabobank reports

Agtech start-ups that find creative solutions to capital and commercial partnerships are well positioned to navigate the challenging funding climate.

Agtech start-ups continue to face a capital crunch as venture capital funding remains sluggish, but the lull in activity might be a perfect time for founders — and investors — to capitalize on the moment by creating innovative solutions that deliver value to growers, Nina Meijers, executive director of innovation for Rabobank, told AgTechNavigator.

In recent years, investors in software-as-a-service companies pushed back on ag and food-tech, leading to lower valuations for start-ups, Meijers explained at Future Food-Tech Chicago last month. Agtech investment totaled $1.6 billion across 137 deals in Q1 2025, a drop from $1.7 billion across 182 investments, according to Pitchbook data.

Fears for tech adoption as EU ‘declares war’ on farmers

Ringfenced EU funding for farming is being cut by more than a fifth under new proposals.

Farmers’ ability to adopt newer sustainable practices will be hit by changes to the EU farm budget, groups have warned.

Commission President Ursula von der Leyen unveiled plans on Wednesday last week to cut funding for the EU’s Common Agricultural Policy from €386.6bn to €300bn after 2027 as part of a sweeping revision of the bloc’s next long-term budget.

New €1 billion EU-wide funding for agtech sustainability

The European Investment Bank (EIB) signed partnerships with Rabobank and DLL to provide €1 billion in loans targeting SMEs and mid-caps focused on sustainability and agriculture.

The funds are earmarked for the energy transition, bioeconomy initiatives, and agri-tech modernisation across EU countries. The deals prioritise climate action and sustainable food and energy transitions.

Rabobank will borrow €250 million from the EIB and match this amount with its own funds, making €500 million available to support small-scale projects with a focus on sustainability and agriculture.

At least 40% of investments are earmarked for climate-relevant investments, and at least 40% of the available funding will be directed towards bioeconomy sectors, including agriculture.

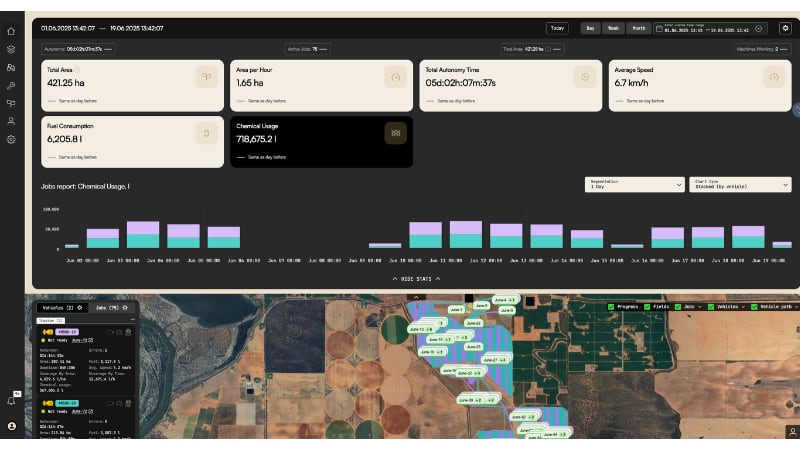

Bonsai Robotics launches telemetry service, autonomizing specialty crop operations

Bonsai is following up its Series A round with a new service for autonomizing specialty crop production.

San Jose-based Bonsai Robotics launched its Teletrace software to autonomize a suite of ag machines for specialty crop operations through its Topcon CL-55 telemetry device, six months after the start-up raised $15 million in a Series A round.

The Topcon CL-55 is a telemetry device that plugs into a machine’s controller area network (CAN) bus, the machine’s communications system. The telemetry device stores the data locally when navigating up and down rows and then transfers field data in batches via Starlink or other internet services, Tyler Niday, CEO and co-founder of Bonsai, told AgTechNavigator.

This device connects the tractor to Topcon’s CloudLink service, which allows growers to monitor various metrics like chemical applications, fuel efficiency and any obstructions like tumbleweeds that robots come across through a cloud-based portal, Niday explained.