Only a few companies have taken phages from the lab bench to the global market.

Phagelux AgriHealth, a biotechnology firm, is quietly establishing a commercial beachhead across crops, animals, and food safety.

With more than a dozen products commercially available across North America, China, and Europe, and manufacturing operations in both Salt Lake City and Nanjing, the company is part of a rare breed: a self-funded phage firm with global reach.

“That’s unusual in this space,” Matthew Tebeau, COO of Phagelux, acknowledges. “We’re open to venture or growth capital, but we’ve been self-sufficient to date. It’s allowed us to grow deliberately and focus on commercial execution.”

We sat down with him at the recent Dallas based Animal AgTech Innovation Summit to unpack what it really takes to make phage work for farmers, not just scientists.

“You know, for a phage product to be commercial, you need to manufacture at scale, hit the right price point, and fit seamlessly into a farmer’s system,” Tebeau says plainly. “We can talk about benefits until we’re blue in the face - but farmers are under constant cost pressure. They want to make money by saving money.”

If a technology is not affordable and easy to use, it won’t be adopted, he adds.

Communication is another big challenge. “You’re dealing with a novel solution, so the customer has to understand how to use it effectively within their existing operations - whether that’s growing crops, managing poultry, or working in food processing.”

Education and support are critical.

Phagelux has put a huge amount of effort into product validation. “Last year alone, we ran over 60 trials globally with both industry and academic partners.”

Another core strength of the company is manufacturing, maintains Tebeau. “This is essential for any phage product to be commercially viable.”

The company has established facilities in Salt Lake City and Nanjing, China. “That capacity allows us to reliably meet volume demands, maintain quality, and scale production cost-effectively.”

Phagelux’s four business units span crop sciences, animal health, food safety, and contract manufacturing.

Its animal health solutions are designed to reduce the impact of pathogenic bacteria - like Salmonella and E. coli - in poultry, swine, cattle, and aquaculture.

“We’re starting with poultry - it’s the fastest route to market - but we’re developing for swine and beef as well.”

But the company’s tagline stresses that phages are one tool and not a silver bullet in pathogenic control.

“We’re not selling a panacea,” Tebeau continues. “That was part of the hype cycle.”

Antibiotic free production is challenging. The US poultry sector has been shifting away from the No Antibiotics Ever (NAE) label.

Farmers need alternatives that are effective, affordable, and simple, says Tebeau.

Producers want a product that works, and one that doesn’t demand access or oversight. When you design a solid, synergistic product, and it overwhelms bacteria effectively, you don’t need to tweak it constantly, he stresses.

So, what’s next?

Tebeau’s experience in animal health brought him to Phagelux not just for its science, but for its grounded strategy and commercial maturity.

“It was already doing a lot of the hard things right - manufacturing, customer integration, real-world testing. That’s rare. My role was to help scale that.”

With existing sales in poultry, swine, shrimp, and crop systems, Phagelux is now expanding its US footprint, while maintaining a solid commercial presence in China, where it has sold phage products since 2014.

In shrimp farming, the company has found success addressing Vibrio-related diseases. “Our product built for China actually works well across Asia,” Tebeau remarks. “And with new diseases like Translucent Post-larval Disease (TPD) emerging, we’re seeing that broad-spectrum utility is a major asset.”

“Over the next three years, we’re focused on growing sales across our three major verticals, especially in the Americas,” Tebeau says. “We want to deepen market penetration, improve product formulations where it makes sense, and keep doing what we do best - serving customers with practical solutions that work.”

The company has built a strong phage library and bacterial understanding. “Now we’re applying that to the points in the production cycle where it really matters,” he concludes.

AMR prevention and control

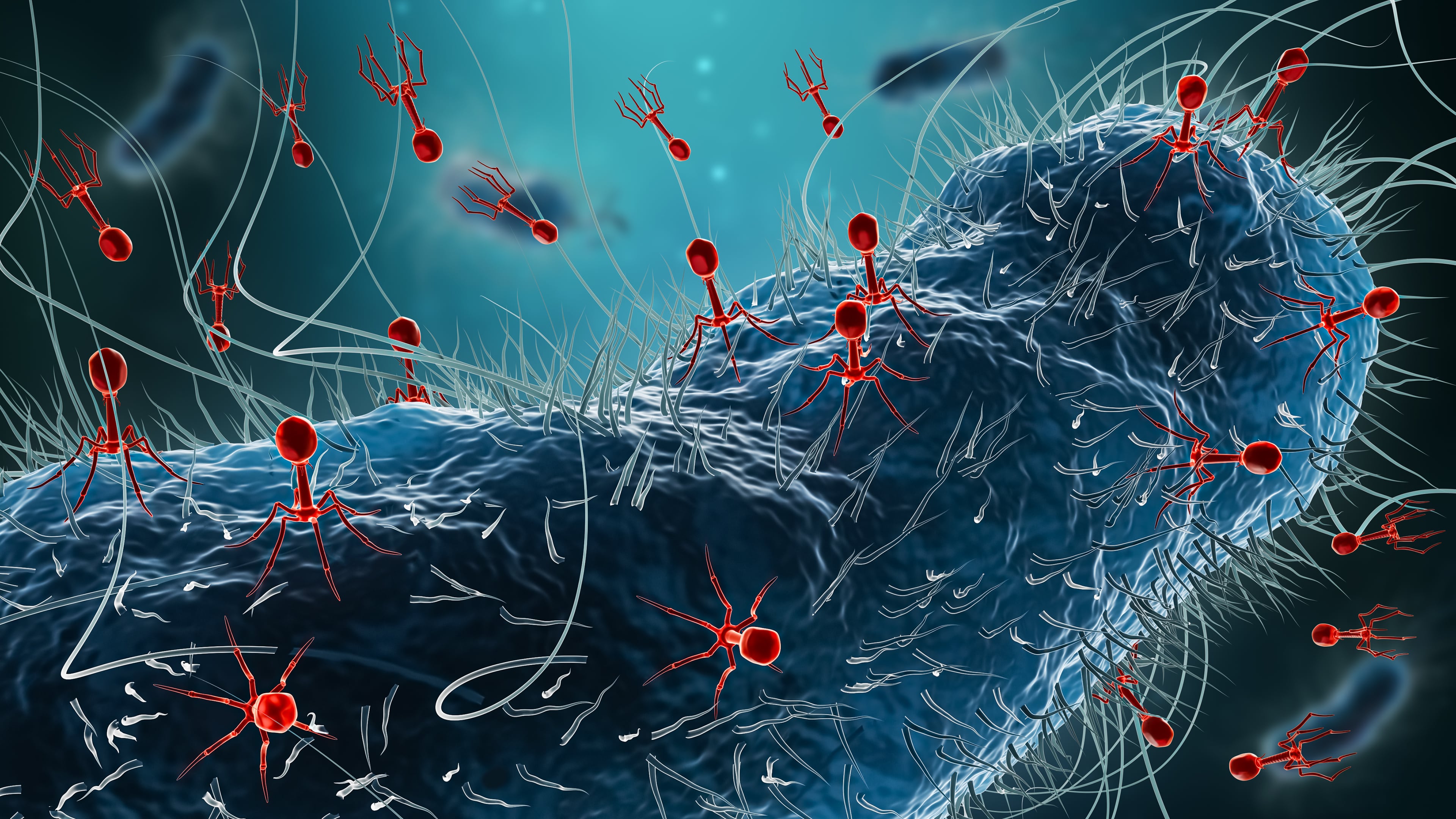

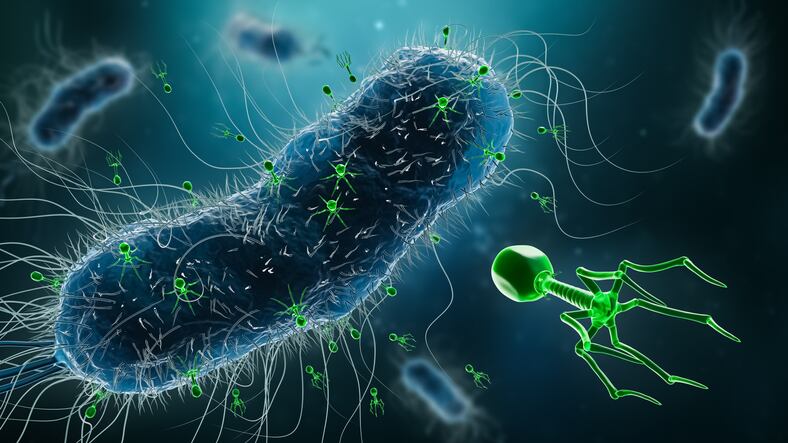

Phages are considered a promising tool for AMR prevention and control. Their high specificity to bacterial hosts enables them to target and eliminate harmful bacteria without affecting the beneficial microbiota in the body, contrasting with broad-spectrum antibiotics, according to a newly published WHO report.

The WHO Regional Office for Europe is working in close collaboration with the Global AMR Research and Development Hub (Global AMR R&D Hub), investigating the potential practical applications and current scientific evidence supporting the use of phages.

“This initiative aims to strengthen the scientific foundation for the potential broader adoption of phage in addressing AMR, examining their application from a One Health perspective across human, animal and environmental sectors in line with the WHO Regional Office for Europe’s commitment to One Health.”

Building long-term relationships

PhageLab, a Chilean biotech company, has been actively engaging in the Brazilian market.

According to CFO Sabrina Torgan, building long-term relationships with clients is central to the company’s approach. “Brazil is a market that requires trust and time. It is a huge, highly integrated, and professionalized market, with very high standards and significant export activity. That makes it a great country to work with.”

One of the key concerns in working with export markets is regulatory compliance. However, Torgan claims that introducing phage technology has not been an issue. “Phages are eliminated from the birds within three days after application, so there’s no residue.”

And while Brazilian legislation is not easy to navigate, she says the company has managed to develop a process to register and update its products in that market.

PhageLab’s portfolio is focused on precision phage therapies, with two flagship products, one that targets E. coli and another that tackles Salmonella.

Both products include phage cocktails that are regularly updated.

“We continuously monitor the bacterial strains in the field. Since bacteria evolve, we have to update the cocktails accordingly,” Torgan tells us at the Dallas event. “We use AI to predict which phages will be most effective against emerging strains. Although we collect data monthly, we would typically update the product annually.”

As regards poultry production, Brazil and the US share similar structures - large, integrated producers, standardized practices, and a willingness to adopt performance-based innovations, she says.

One standout aspect of PhageLab’s business model is its performance-based pricing. “For E. coli, we measure KPIs like mortality rate. For Salmonella, we compare results with control groups. If the product shows a measurable improvement, we charge accordingly.”

PhageLab’s model emphasizes local adaptation. “We don’t believe in one-size-fits-all. We develop products based on the microbiome of the client’s specific environment. We apply the product, monitor the results, share data, and adapt the formula as needed.”

The company has 20 team members on the ground in Brazil, mainly concentrated in the south and near São Paulo. “We can update cocktails in under 30 days if needed,” Torgan notes.

It is all based on field data, bacterial profiles, protocols, farm conditions - which means PhageLab needs close contact with producers, she continues.

The company is also partnering with MSD Animal Health in the Brazilian market for distribution of certain phage-based products, such as those for calf diarrhea. These are more static formulations that don’t require constant updates, so the distribution model works well, she outlines.

Looking ahead, PhageLab is focused on expanding its presence in the US, Chile remains an important but smaller market, while other Latin American countries like Mexico pose new challenges due to less standardized practices.

The company also wants to get a deeper understanding of producer challenges, develop tailored solutions, and work closely with research institutions, reports Torgan.

Additionally, it is looking to integrate AI in many parts of its operation. “We work with an enormous amount of data. But having data isn’t enough. We need to understand it, extract insights, and find ways to monetize it.”

PhageLab currently administers its phage products through drinking water, but one of its major R&D initiatives is aimed at incorporating them into animal feed, which is complex as phages are extremely sensitive and can be destroyed by heat or chemicals like chlorine.

EU authorization milestone

Last month saw established Polish phage producer, Proteon Pharmaceuticals, announce a regulatory breakthrough for its flagship product, BAFASAL, a bacteriophage-based zootechnical feed additive designed to reduce Salmonella Enteritidis in poultry.

The product received a qualified majority vote from EU Member States during the May 2025 session of the Standing Committee on Plants, Animals, Food and Feed (PAFF Committee) in Brussels, a key step toward full EU authorization.

The approval marks the first time a phage-based zootechnical feed additive is set to be authorized for poultry use across the EU. The draft regulation is now entering its final stages, which include official translation, adoption by the EU Commission, and publication in the Official Journal of the EU.

“This step forward reflects years of dedicated research and regulatory engagement and demonstrates that phage-based innovations are gaining recognition within the EU framework,” notes Dr Małgorzata Stańczyk, chief registration and IP officer at Proteon.

The upcoming authorization is grounded in a scientific review by the European Food Safety Authority (EFSA), which concluded that BAFASAL is both safe and effective in reducing Salmonella Enteritidis contamination. The additive can be administered via drinking water or liquid complementary feed for all poultry species.

At the Animal AgTech Innovation Summit in Amsterdam in October last year, Justyna Andrysiak, chief product and technology officer at Proteon, detailed her company’s pioneering research in phage applications over 15 years.

“What’s innovative in our approach,” Andrysiak explains, “is that today we have the tools to characterize and produce bacteriophages in a scalable, repeatable way.”

She notes the rapid progress in molecular biology and AI-driven genomic analysis, enabling Proteon to conduct in-house characterization of phages and tailor specific, synergistic cocktails to enhance product stability, specificity, and resistance resilience.

Proteon has built a comprehensive dataset on the safety and efficacy of phage products, including tolerance and mutagenicity data, she adds.