US-based agronomy platform FarmQA is bolstering growth with $4 million in seed preferred funding — led by venture fund gener8tor 1889 and participation from O’Leary Ventures and Badlands Capital — while the tech company eyes partnerships and potential merger and acquisition (M&A) targets to expand capabilities, its CEO Kris Poulson said.

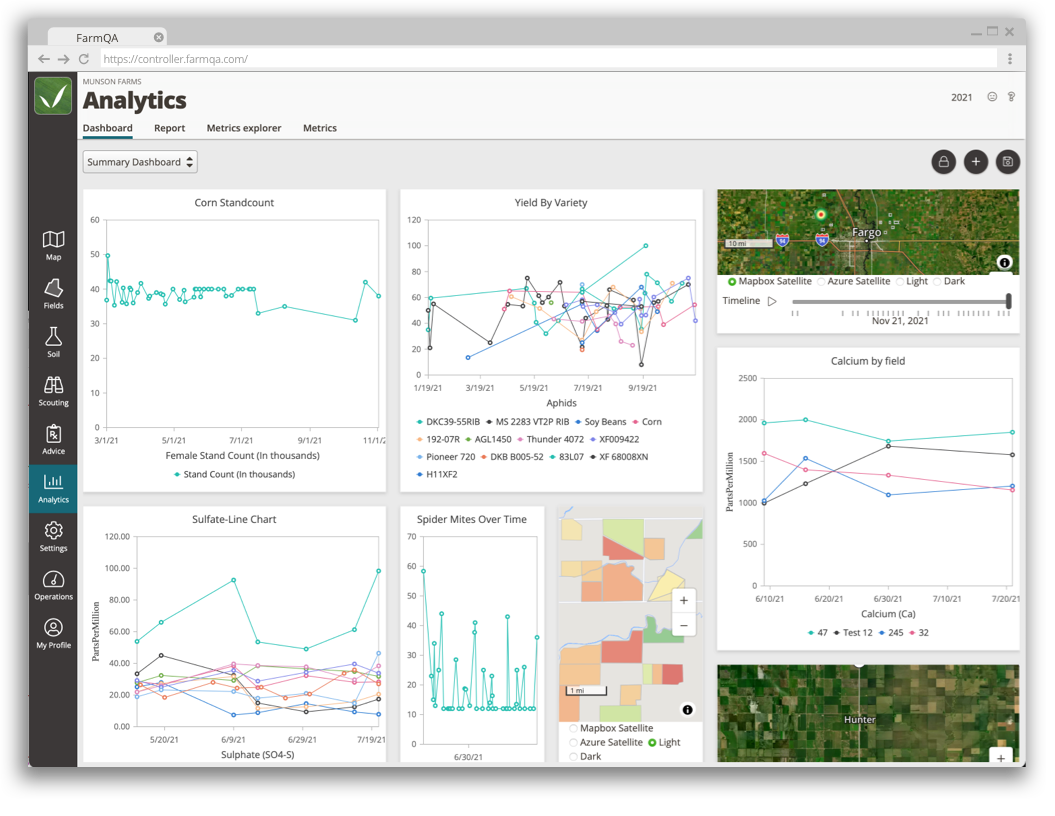

Built on Microsoft’s Azure cloud, FarmQA offers a suite of digital agronomy capabilities, including features to manage pest, disease and weed data, and ways to track fertiliser usage and disease mitigation efforts, the company shared. Agronomists track the condition of specific fields within the app, which allows them to communicate directly with growers or get directions to specific farms, Poulson explained.

Real-time communications between on-the-ground agronomists and growers are becoming increasingly important, as sudden weather events and market volatility — including on-and-off tariffs — can impact the growing and sale of agriculture products, Poulson said.

“Real-time or close to real-time information ... is pivotal for decision making at the farm gate because the decisions are not a few $100 here, a few $100 there. They are 10s of 1,000s of dollars of decisions that can literally wash away with a rain,” he elaborated.

FarmQA bucks agtech funding trends

FarmQA will use the $4 million in capital to bolster marketing and sales while expanding the team and supporting existing clients, Poulson noted. The tech company’s platform covers close to 40 million acres and has a client retention rate of 92% for 2025, he added.

“All the information in our system is extremely clean, which is very rare in agriculture. We have a ton of data. So, our ability to run large language models and AI or utilize large language models and build an AI engine to do unique things for our clientele, it would be second to none.”

Kris Poulson, CEO at FarmQA

Poulson admitted that the venture capital (VC) funding landscape is the toughest that he’s seen it in the 10 years he’s been fundraising. The agtech space is “set up for another 12 to 18 months of slower growth,” he added.

Previously, Poulson co-founded drone field-scouting company Sentera, which was recently scooped up by John Deere for an undisclosed amount of money.

VC investments in agtech started the year with another quarter of slower deal flows with 137 deals made worth $1.6 billion in Q1 2025, a drop from 182 deals worth $1.7 billion in Q4 2024, according to Pitchbook data.

“The reason that we were able to have success is we have a leadership team with a proven track record. [They] have gone out, started companies, sold companies professionally and ran companies, and then [we] also have a product that speaks for itself,” Poulson said.

Is FarmQA’s next step to acquire or partner?

FarmQA company is also exploring potential M&A deals and further partnerships to bolster its aggressive growth strategy, Poulson said. Last November, the tech company acquired agricultural data company Farm Dog for an undisclosed amount of money.

FarmQA is “going to be pretty strategic” when it comes to acquisitions, ensuring the company or the people that come over as part of the acquisition (i.e., an acquihire) would complement and strengthen the company’s position, Poulson said.

“We are growing at a very rapid clip, organically, so inbound leads coming in and outbound reach out as well. But we also know to hit some of our lofty growth targets that we would have to augment some of that organic growth through mergers and acquisitions,” he elaborated.

Additionally, FarmQA have “some partnerships looming,” further expanding the reach of the tech company’s platform, Poulson said.

In April, FarmQA integrated its service into grower management service company ExtendAg’s platform through the ExtendAg Agronomics Gateway. This integration allowed FarmQA to surface field-level data into the ExtendAg platform, Poulson shared in a LinkedIn post.

“You look at ExtendAg, and they are really good at contracting all the other things that processors need to do to interact with the grower, but they do not do any agronomy — much like we do not do anything with contracting," Poulson said.

ExtendAg “was a unique opportunity to partner with someone completely different than you,” he added.

FarmQA’s AI potential: ‘We have a ton of data’

FarmQA is also exploring ways to tap into the interest around AI, given the vast amount of agriculture data the tech company processes, Poulson said.

“All the information in our system is extremely clean, which is very rare in agriculture. We have a ton of data. So, our ability to run large language models and AI or utilise large language models and build an AI engine to do unique things for our clientele, it would be second to none,” Poulson said.

“We are in the early stages of figuring out exactly where we want to start. We have some really good ideas, and some things are wire framed up,” he added.