It has been warned that the 45Z Clean Fuels Production tax credit – which encourages the production of clean fuels in the US – may be on the chopping block by the new Trump administration.

Any scrapping of 45Z could slow the advancement of environmentally sustainable energy production, according to Mike DeCamp, CEO of CoverCress. The St. Louis-based company grows a winter oilseed crop that serves as a renewable feedstock for various sustainable fuel applications.

DeCamp said: “Since 45Z is part of the tax code intended as a direct incentive for fuel producers to create fuels with low carbon intensity, if this credit didn’t materialise, I would have to believe it could slow down the pace of development of production facilities as well as technology advancements along all points in the supply chain.”

But he added that 45Z not materialising will “not be fatal” to the industry as programmes like Renewable Fuel Standard (RFS) and the Low Carbon Fuel Standard (LCFS) in California still exist and function separately from tax incentives, with more of a focus on the volume of renewable fuels that are blended into petroleum-based fuels. Meeting these volume targets and mandates, he stressed, “will continue to require feedstocks for the production of the fuels which should continue to benefit a crop like CoverCress”.

Are cover crops the future of fuel?

The company’s business model also protects it from regulatory machinations. CoverCress has developed a new winter oilseed crop by genetically modifying pennycress using CRISPR gene editing technology.

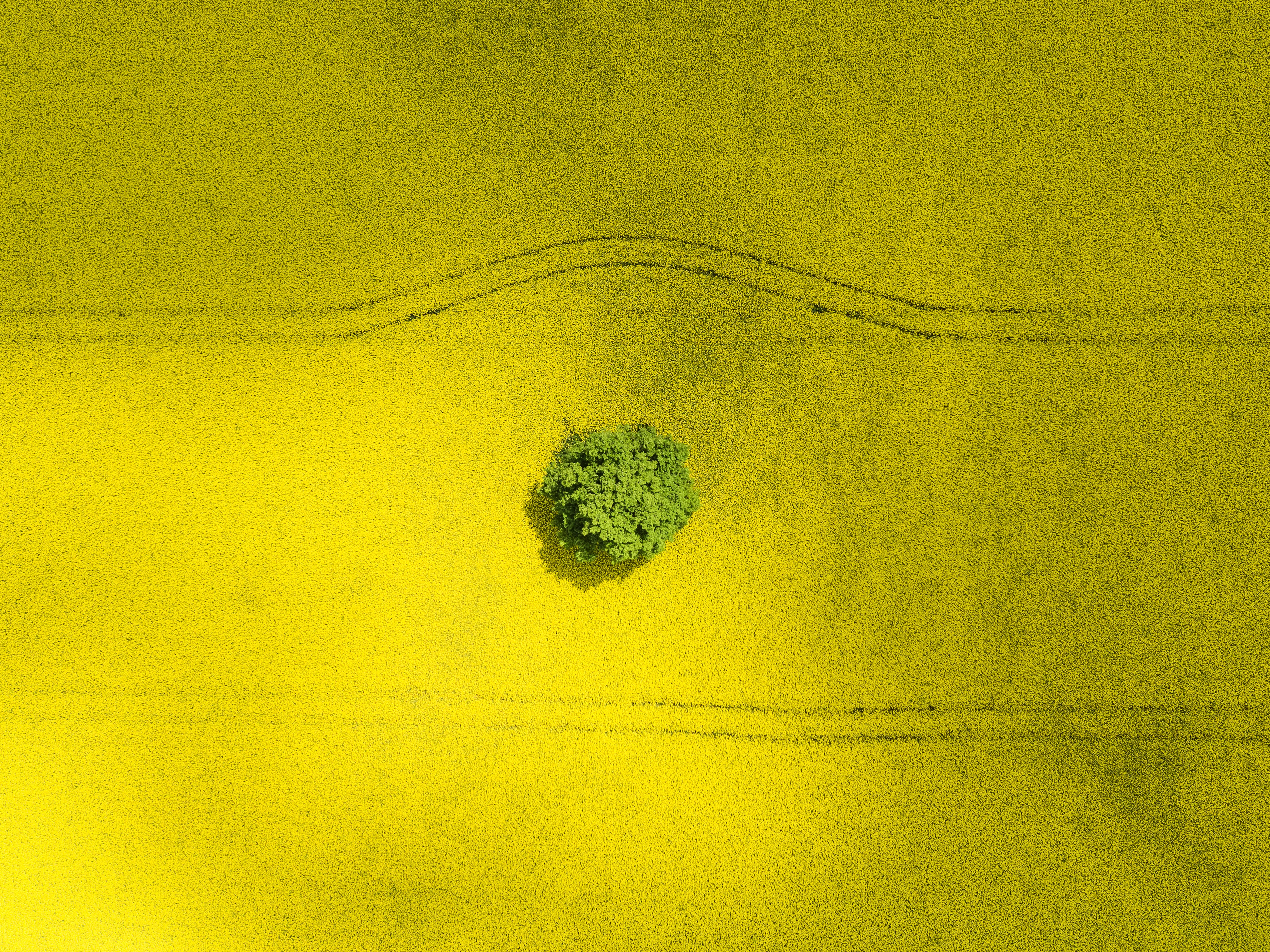

The crop, branded as CoverCress, can be integrated into existing corn and soybean rotations and combines the benefits of a cover crop, such as improved soil health and carbon sequestration, with the potential for additional revenue for farmers.

Farmers receive complimentary CoverCress seed, with potential earnings estimated between $150 to $200 per acre.

The programme requires no upfront costs, new land, or additional equipment from farmers, who plant CoverCress during the winter months between their regular crop rotations.

CoverCress – which is owned by Bayer (which has a 65% majority stake), Bunge and Chevron (both 35%) – then manages the collection of the harvested crop from farmers.

The harvested CoverCress is processed by Bunge into various products such as oil for renewable fuel production, and high-protein meal and whole grain for animal feed and ingredients.

CoverCress is investigating how it can be used as a fertiliser. It is also exploring how to be classified as a conservation practise that can lower the climate impact score of corn or beans, which will again give farmers enhanced value for their crop.

CoverCress is still in its early stages of commercialisation. It currently operates on 6,000 acres – double that of last season. It targets planting on 10,000 acres this fall. “From a profitability standpoint, it’s gonna be the latter part of this decade when we’ll have the scale necessary to be earnings positive,” DeCamp said.

But given the plentiful potential revenue streams available on offer, the CoverCress programme “phenomenal” interest in adoption by farmers, he added.

“We’ve been very pleased with the farmer adoption side of things. I think farmers are very excited about the opportunity to get a third revenue stream in a system where you used to only get two whilst also getting all the attended benefits of a cover crop.”

Why Bayer backs sustainable fuel

Bayer is also positioning itself to meet the growing demand for renewable diesel and sustainable aviation fuel, which it estimates to increase from 14 billion to 40 billion gallons by 2040.

As well as its tie-up with CoverCress, it has partnered with Neste, the world’s leading producer of renewable diesel and sustainable aviation fuel, to develop a US-based winter canola ecosystem for renewable fuel production.

It has also acquired camelina germplasm, intellectual property, and materials from Smart Earth Camelina Corp to expand its position in biomass-based feedstock markets.

“At Bayer, we are connecting the dots between regenerative agriculture, and the aim to help decarbonize the transportation sector,” a spokesperson said. “Meeting the Global demand for biofuels cannot be done alone; it requires considerable investment in biomass-based feedstock innovation, collaboration along the value chain and supportive energy policies to drive scale.

“New low-carbon crops can be used to produce renewable fuels like sustainable aviation fuel and renewable diesel, and when grown within a regenerative system can improve soil health and sequester carbon, resulting in more sustainable farming all while providing farmers new income opportunities.

“Our investments in low-carbon biomass-based feedstocks underscores our commitment to regenerative agriculture, and agriculture’s opportunity to contribute to the decarbonization of the transportation sector.”

Mike DeCamp is scheduled to speak at the at the World Agri-Tech Innovation Summit in San Francisco in March.