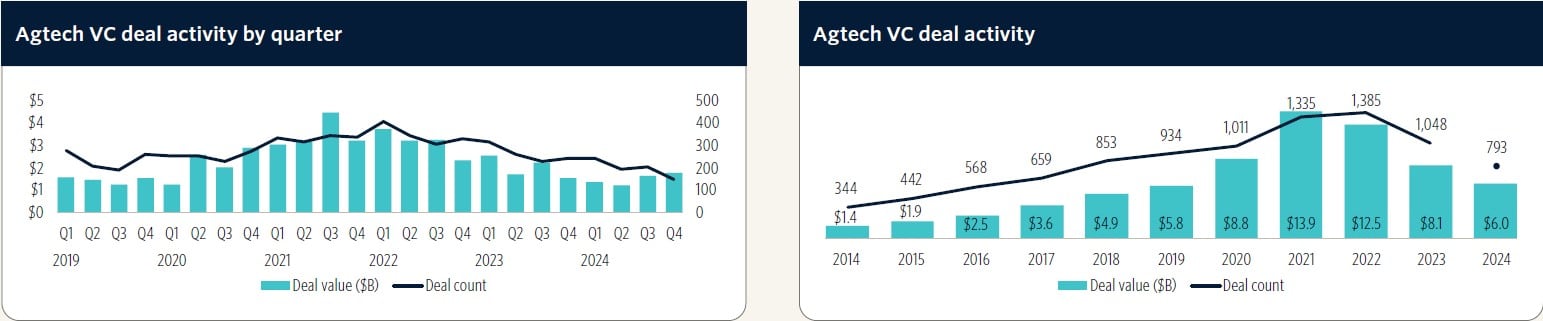

Last year concluded with a strong fourth quarter, reveals data from Pitchbook, with agtech venture capital deal activity growing to $1.8 billion across 149 deals – an 8.9% increase on the previous quarter.

Despite this, annual agtech VC activity in 2024 still experienced a significant decline, with deal value and count falling 25.6% and 24.3% respectively.

This downturn was mainly put down to high interest rates, unfavorable trading conditions for public agtech companies, and a challenging exit environment.

The bump in activity in the fourth quarter also masked a fall in early-stage start-up investments, particularly in pre-seed/seed deals. These fell 33.7% year-on-year. This shift was evident in the quarter’s top deals – both Series D rounds: Sound Agriculture’s $100 million raise and the $70 million scooped by Carbon Robotics.

Precision ag the standout sector

But there were some standout sectors in what was a tumultuous year, the report revealed, with AI and autonomous solutions, precision agriculture, gene editing, and biological inputs emerging as dominant trends.

“These technologies garnered significant attention from investors who recognised their potential to address critical global challenges such as food security and climate change,” the report says.

“The continued focus on these areas underscored the industry’s commitment to developing innovative solutions that could revolutionise agricultural practices and contribute to a more sustainable future.”

This shift toward more sustainable and environmentally friendly agricultural practices reflects “a broader industry trend of balancing productivity with ecological responsibility”, it adds.

Precision agriculture was the leading segment, attracting $2.1 billion across 238 deals in 2024. Increased demand for automation, robotics, and software solutions – driven by persistent labour shortages – fuelled this trend. Remote crop health monitoring technologies, particularly those using aerial imagery, saw substantial funding, with notable deals for the likes of Pixxel, Muon Space, and EarthOptics.

Indoor farming woes... Asia is making strides

Suprise suprise, the indoor farming sector faced significant challenges: 28 companies ceased operations or declared bankruptcy last year. Bowery, once valued at $2.3 billion, shut down in November 2024. But the segment was not without its successes, as evidenced by Oishii’s $150 million Series B round, valuing the start-up at $615 million.

The US remains the leading recipient of agtech VC, but Asian countries made notable strides, accounting for three of the top 10 deals. The largest deal of the year was a $200 million Series C investment in Malaysia’s Aerodyne for industrial drones used in agriculture and other sectors.

Exits are falling

Exit activity fell in 2024, with only 35 exits totaling $1.1 billion, down from the 63 totalling $35 billion in 2023.

The most prominent exit came from veterinary therapeutic developer Invetx’s acquisition via LBO by Dechra Pharmaceuticals for $520 million. The year saw three public listings in the agtech sector: Synspective’s IPO on the Tokyo Stock Exchange, Bolt Threads’ public listing via SPAC, and Kweather’s IPO on the Korea Stock Exchange.

Notable acquisitions highlighted the growing importance of AI and advanced imaging in agriculture, including Kubota Corporation’s purchase of Bloomfield Robotics and GEA Group’s acquisition of CattleEye. Ginkgo Bioworks’ acquisition of AgBiome signified the adoption of biological alternatives to traditional chemicals and growing awareness of regenerative farming practices.

But is a rebound coming?

But for all the carnage of 2024, the Pitchbook report still anticipates a rebound in the agtech market—particularly for innovative companies with strong commercial traction—as the economy recovers and interest rates are cut.

“The industry’s focus on capital-efficient solutions and sustainable growth, coupled with advancements in regenerative agriculture, ag biologicals, and robotics, positions it for potential growth in the coming years,” it says.

“As the sector moves forward, it will continue to address critical global challenges, with increased emphasis on sustainability, food security, and climate change mitigation. The lessons learned from the challenges of 2024 will likely shape a more resilient and focused agtech industry in the future.”

But another takeaway is that the debate about whether alternative funding models or adaptations to the traditional VC model are required to spur long-term agtech innovation is set to remain.